Have you ever found yourself staring at a payment screen, wondering how much to tip for a service you previously wouldn’t have considered tipping for? You’re not alone. Welcome to the digital tipping economy, a landscape increasingly shaped by what many are calling “tipflation.” This phenomenon reflects a significant shift in our service economy, where mandatory tipping prompts and suggested gratuities on digital platforms are leading to increased spending fatigue and influencing consumer behavior. This guide will explore the rise of tipflation, delving into the psychological and financial impacts it has on you, the consumer, and offer strategies for navigating this evolving financial landscape.

Understanding the Digital Tipping Economy and Its Evolution

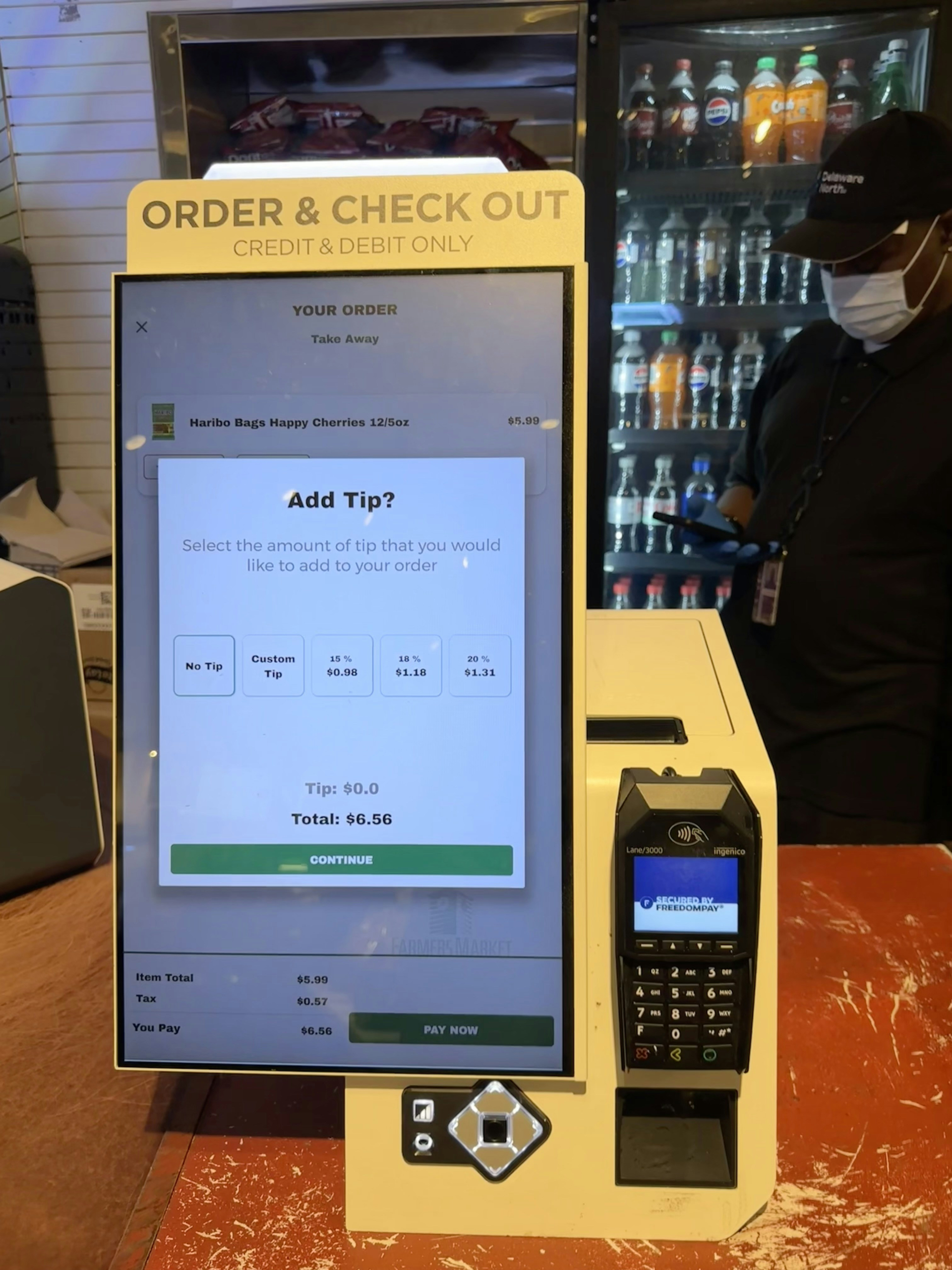

The service economy has undeniably transformed, leading to what many now call tipflation. You’ve likely encountered this phenomenon, where digital payment screens frequently prompt for gratuities, often at unexpected establishments. This isn’t just a slight increase; consumers report paying around $150 annually in tips they deem unnecessary. Moreover, 77% of consumers now find U.S. tipping practices “ridiculous,” indicating a significant shift in consumer behavior.

You might be wondering about the prevalence of these requests. On average, consumers are asked to tip for various services approximately ten times a month! This constant expectation significantly contributes to spending fatigue, leading 43% of consumers to tip less this year.

To better understand where tipflation is most keenly felt, consider the following:

| Service | % of Consumers Who Tip |

|---|---|

| Restaurants | 94% |

| Hair salon/barber | 68% |

| Taxis/ride services | 46% |

| Grocery delivery | 45% |

The Psychological and Financial Impact of Tipflation on Consumers

You’re likely feeling the effects of tipflation, as the service economy increasingly prompts for gratuities in various scenarios. This rise in solicited tips impacts your consumer behavior both psychologically and financially. Many consumers report experiencing spending fatigue due to the constant requests.

Consider the data on how this trend affects you:

| Impact Type | Detail |

|---|---|

| Financial | Consumers paid approximately $150 in tips they deemed unnecessary in the last year, with 65% feeling fed up with tipping, an increase from 60% last year. |

| Psychological | 66% of you feel pressured to tip when digital screens suggest amounts, especially in front of employees, leading to “guilt tipping.” |

In the current service economy, both businesses and consumers must adapt to the evolving tipping landscape. As a consumer, you face tipflation and spending fatigue, with 77% of consumers finding U.S. tipping “ridiculous.” You are asked to tip, on average, ten times a month, leading 43% to tip less. To combat guilt-tipping, remember that 66% feel pressured by digital screens. Don’t feel obligated to tip if service is poor, even if 64% of consumers have done so.

For businesses, understand that 62% of consumers would rather pay higher prices to eliminate tipping. This data suggests a potential shift in consumer behavior. Consider transparent pricing models that reflect fair wages, reducing the reliance on variable tips.

| Tipping Scenario | Consumer Action | Business Strategy |

|---|---|---|

| Digital Tipping Prompts | Tip based on genuine satisfaction, not guilt. | Offer flexible tipping options or fixed service charges. |

| Poor Service | Exercise discretion; tipping is not mandatory. | Prioritize excellent service to encourage gratuity. |

| High Tipfatigue | Prioritize establishments with transparent pricing. | Explore alternative compensation models for staff. |

Frequently Asked Questions

What is ‘tipflation’ and why are consumers experiencing fatigue?

Tipflation refers to the phenomenon of increased pressure on consumers to tip, often at establishments where tipping wasn’t traditionally customary, and for higher amounts. Consumers are experiencing fatigue due to being asked to tip approximately ten times a month, on average, for various services. This constant prompting, especially through digital payment screens that suggest gratuity amounts, leads to a feeling of obligation or ‘guilt tipping.’ A significant majority (77%) of U.S. consumers believe that tipping has become excessive, with 65% stating they are fed up with it, an increase from previous years.

How has tipping evolved in restaurants and for delivery services?

Tipping trends in restaurants have shown a positive upturn recently. After a few years of decline, 45% of consumers now tip 20% or more for restaurant servers, an increase from 38% last year and slightly above the 2022 high of 43%. However, tipping for delivery drivers, while improving from 19% last year to 23% this year for 20% or more tips, still lags significantly behind its 2022 peak of 32%. This indicates a recovery in restaurant tipping but a slower rebound for delivery services, which may reflect shifting consumer perceptions or economic pressures.

What is the impact of digital payment screens on tipping culture?

Digital payment screens have a substantial impact on tipping culture, particularly by increasing the pressure consumers feel to tip. Two-thirds (66%) of consumers admit to feeling obliged to tip when digital screens suggest gratuity amounts, especially when an employee is present. This often results in ‘guilt tipping,’ where individuals tip even for poor service (64%), out of sympathy for a worker (52%), or to avoid appearing cheap (45%). These digital prompts contribute significantly to the perceived overreach of tipping expectations, leading to consumer frustration and fatigue.

Are there generational differences in tipping habits?

Yes, significant generational differences in tipping habits have been observed. According to various studies, Generation Z and millennials tend to be the least frequent tippers. For instance, only about 43% of Gen Zers and 61% of millennials consistently tip at sit-down restaurants, compared to 83% of Gen Xers and 84% of boomers. Bartenders, in particular, have noted a decrease in tips from younger patrons, with some expressing that even financially well-off Gen Z individuals are ‘skimping on tips.’ Possible reasons for this trend include financial constraints, unfamiliarity with traditional tipping conventions, or a general shift in attitudes toward gratuities due to factors like the COVID-19 pandemic.

Comments are closed.